Target-date funds (TDFs) have become the standard default investment choice for 401(k) plans since the 2006 Pension Protection Act approved them for this use. However, TDFs from different providers should not be considered perfect substitutes. They differ in several key areas: investment philosophy, glide paths, and costs. Understanding these differences is a requirement of plan sponsors under ERISA’s “prudent expert” rule when choosing the investment line up for their 401(k) plan. This paper seeks to explain the distinctive characteristics of TDFs in an effort to help investment committees choose a TDF series in a manner that will satisfy the “prudent expert” requirement.

Issues with Choosing the Right Target Date Funds for your 401(k) Plan:

Considerations for

Investment Committees

Patrick A. Lach

†

Eastern Illinois University

Marin Financial Advisors, LLC

April 29, 2013

1. Introduction

The 2006 Pension Protection Act allowed sponsors to add target-date funds (TDFs), risk based investments, and professionally managed portfolios to defined contribution plans as qualified default investment alternatives (QDIAs) and for the plan sponsor to receive “safe harbor” if they use these options as QDIAs. This means that participants can be automatically placed into a TDF, a risk based investment, or a managed portfolio without the participant making any elections and that the sponsor will not be responsible for investment losses stemming from putting the participant into the QDIA. However, the “safe harbor” only applies to the process if the QDIA was selected in a manner consistent with the “prudent expert” rule. If the QDIA was not selected in a manner consistent with the “prudent expert” rule, the sponsor has breached its fiduciary responsibility to the participants and is liable for participant losses.

The Employee Retirement Income Security Act (ERISA) requires that plan fiduciaries act as “prudent experts” when choosing the investments in 401(k) plan, including QDIAs. Under ERISA, a fiduciary must use the “care, skill, prudence, and diligence, under the circumstances then prevailing, that a prudent man acting in a like capacity and familiar with such matters would use in the conduct of an enterprise of a like character and with like aims.” It is up to the sponsor to determine if they feel they have the resources within the firm to meet this requirement. If the sponsor doesn’t feel they meet this requirement, ERISA encourages the sponsor to retain an expert to help make investment decisions.

While not all plans have a QDIA, plans with QDIAs on the Vanguard platform are split such that 90% have selected a TDF and 10% have selected a balanced fund. In the past, money market funds and stable value funds were the most prevalent QDIA investment choices. The appeal for TDFs and other professionally managed investment options, such as balanced funds and managed accounts in 401(k) plans is clear. They apply professional management to participant balances. This is important because several studies, most notably Dalbar (2013) show that returns to the average investor fail to match those of conventional benchmarks. Furthermore, Gilharducci (2012) has argued that a problem with 401(k) plans and other individual retirement accounts is that they expect individuals to construct an investment portfolio with the same skill and diligence as a professional portfolio manager.

Holden, VanDerhei, Alonso, and Bass (2012) find that workers in their 20s have a greater amount of assets in TDFs (13%) and balanced funds (11%) than workers in their 50s and 60s (11% in TDFs and 7% in balanced funds). Given the popularity of TDFs among young investors, demand for these funds is likely to increase as younger investors enter the workforce and seek a simple solution to retirement savings and asset allocation. As demand rises, plan sponsors need to take a close look at how they choose TDFs because their use as a QDIA doesn’t eliminate fiduciary risk to the Sponsor.

The choice of the QDIA is a fiduciary decision and as such plan sponsors are responsible for the prudent selection of and continued monitoring of QDIAs. For this reason, plan sponsors should complete a documented due diligence process when choosing the QDIAs for the plan.

1.1. Distinguishing Characteristics of TDFs

1.1.1. Investment Philosophy

There are two broad categories of investment philosophy: Active management and passive management. Active managers engage in stock picking and market timing in an effort to outperform their peers. Active managers rely on everything from sophisticated mathematical models to ‘gut feelings’ to choose the stocks that make up their portfolios and to decide when the market is going to go up or down. As a result, this strategy includes relatively higher amount of securities trading which can affect asset class exposure. For example, many actively managed equity mutual funds may hold up to 20 percent of their portfolio in fixed income instruments. To execute an active strategy, managers require resources to complete research to identify and take advantage of market inefficiencies. As a result of these expenses active management is the most expensive management philosophy.

Many people illustrate the superiority of passive management by highlighting the flaws of active management. For example Fama and French (2012) find that approximately 80 percent of actively managed mutual funds lose to their benchmark after 10 years. In addition, the high costs associated with active managers reduces the return to the investor, whereas passive management is the least expensive management philosophy.

Passive management occurs when an investment manager does not try to outperform a benchmark or index. Passive management comes in two forms: indexing and structured management. Indexing was pioneered in the 1970s by Vanguard when it introduced its first index fund. Managers who use an indexing strategy attempt to follow specific commercial indices like the S&P500. As a result, they have consistent asset class exposure. Managers who chose to use indexing as their investment strategy are often evaluated by their tracking error, which measures how well they are able to follow their chosen index.

Structured management is similar to indexing in that it does not seek to outperform an index or a benchmark. However, structured management does not attempt to track any specific indices, which means that unlike index funds, where tracking error is an important characteristic, structured managers can avoid being forced into inefficient transactions such as those which are required when an index undergoes reconstruction, which occurs when stocks move in and out of an index. The cost of structured management is slightly higher than the cost of indexing, but still lower than the costs of active management.

Index funds, which seek to minimize tracking error, may be forced to buy a stock when it is added to the index and sell the stock leaving the index on the same day the index is reconstructed. Reconstruction may lead to inefficiencies because the stock entering the index and the one that is deleted from the index are bought and sold simply because the index is changing and not because of any issues with the underlying companies. Reconstruction often increases the price of the stock added to the index and decreases the price of the stock leaving the index. Structured investors can use reconstruction to their advantage by selling the stocks that are going into the index (possibly overpriced) and buying those leaving the index (possibly underpriced). The structured manager will have greater tracking error that then passive manager. In addition, structured management seeks to target dimensions of risk and return with greater precision than passive management.

According to Charlson and Lutton (2012), more than 50 percent of all TDF series are actively managed. Although several industry leaders like Fidelity have introduced TDF series based on index funds, the majority of assets remain in actively managed TDFs. There has been a push to more passive investment strategies such as those offered by Vanguard, Dimensional Fund Advisors, and iShares.

In the face of the 2012 fee disclosure regulations, passive management has become more appealing to sponsors and employees because of the lower costs. Charlson and Lutton (2012) report that index-based TDF series have shown faster growth than active in the past three years and have been gathering assets at about twice the rate. In addition, studies which have cast doubt on the ability of active mutual fund managers to consistently beat the market (see Fama and French (2012)) have helped create interest in structured and passive TDFs.

The decision to choose an active, indexed, or structured strategy is up to the fiduciary and is beyond the scope of this paper. However, research of long term results casts sufficient doubt on the ability of active strategies to outperform passive strategies and therefore plan sponsors should be particularly diligent about their process if they decide to choose actively managed TDFs.

1.1.2. Glide paths

A TDFs glide path refers to the shift from stocks to bonds in TDF as the fund closes in on the ‘target date’.

Charlson, J. and Lutton, L. (2012)

Charlson, J. and Lutton, L. (2012)

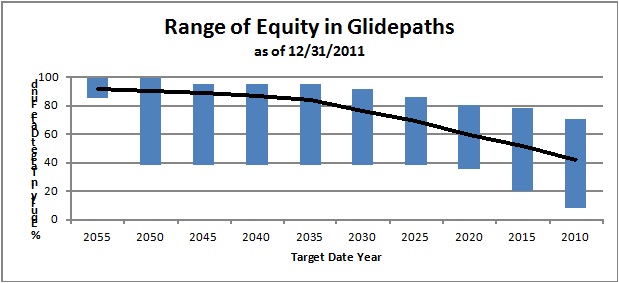

Glide Paths for TDFs reflect the differing views the portfolio managers have in how these vehicles should be run. Even understanding that manager philosophy plays an important role; the range of glide paths is somewhat surprising:

· The greatest range of equity percentages (38%-99%) occurred in the 2050 funds.

· The 2045-2035 funds had the same range (38%-95%) as each other.

· 24% of the 2010 funds had an equity allocation of greater than 50%.

· The maximum equity percentage in a 2010 fund was about the average equity percentage in a 2050 fund demonstrating that there are 2010 funds that have the same stock to bond ratio as 2050 funds however, the individuals in those TDFs plan to retire about 40 years apart.

Since the stock-to-bond allocation is one of the primary determinants of risk and reward in portfolios, understanding the glide path of the TDF series chosen by the investment committee is critically important.

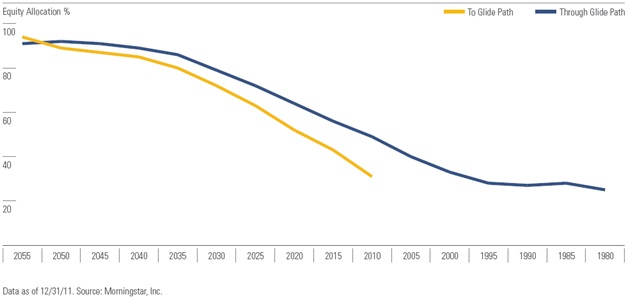

1.1.3. Through or To: It Matters to You

One of the issues which leads to the large range of equity allocations is whether the TDF series is managed in a ‘through’ or ‘to’ manner. Mangers of the ‘through’ TDFs expect that an individual will remain invested in the fund until death. Managers of the ‘to’ TDFs expect that the individual will move from the TDF to another investment option, such as an annuity, when they hit the target date. As a result, the glide paths for the ‘through’ funds continue to lower their equity exposure for several years after the ‘target date’ has been reached. While the ‘to’ funds will have achieved their most conservative asset allocation when the target date has been achieved. Below is a chart from Morningstar showing how the average glide paths for the ‘to’ and ‘through’ TDFs compare.

We believe that the important characteristic of the TDF is not whether it is managed as ‘to’ or ‘through’ but is what the participant plans to do with their money at the target date. For example, in the 2008 crisis the most volatile of the 2010 TDFs lost as much as 40 percent of their value. An investor in a 2010 TDF who had plans to buy an annuity in 2010 only to find that their portfolio had declined by 40 percent would have had to significantly impact their lifestyle in retirement or postpone retirement.

|

Starting Principal |

$1,000,000 |

$600,000 |

|

Length of Annuity |

35 years |

35 years |

|

Annual Growth Rate of Annuity |

3% |

3% |

|

Monthly Withdrawal |

$3,838 |

$2,303 |

However, another individual may have understood they were in a ‘through’ fund and therefore might have viewed the 40 percent decrease in context and remained in the TDF.

Under different circumstances both ‘to’ and ‘through’ have their merits. Plan sponsors should understand which type they have and then educate the participants on the proper use of the TDF so that the participants can avoid unexpected outcomes.

1.1.4. Costs

The costs for TDFs can significantly impact the returns investors receive from their investments. Nearly all TDFs are combinations of multiple underlying mutual funds. Mutual funds can be generally classified by the management philosophy of their managers: active, passive, or structured.

ICI (2013) reports that the average expense ratio for TDFs is 1.07%. Vanguard’s passive TDF series has an expense ratio of about 0.17%, making it one of the least expensive TDF series available. A structured TDF would cost about 0.43%. The table below shows the impact of the fees on the balance of an account assuming a worker had 30 years to retirement, contributed $5,000 per year, and achieved an annualized return of 7%.

|

Active |

Passive |

Structured |

|

|

Rate of Return |

5.93% |

6.83% |

6.57% |

|

Balance at Retirement |

$390,454 |

$458,101 |

$437,293 |

The table above summarizes why it is important for investment committees to pursue a prudent process when choosing an active TDF over a passive or structured TDF. For active managers to outperform their index they have to overcome the cost difference between what they require to pursue their strategy and that of the lower cost alternatives.

1.2. TDF Usage

TDFs are intended to be a “set-it and forget it”, one choice option for plan participants. Correctly used, they can provide individual investors with the benefits of professionally managed portfolios. However, Janus (2009) found that 65% of 401(k) plan participants believe they need to combine a TDF with other investments to achieve their retirement objectives. Furthermore, the same study found that 63% of participants felt that a TDF needed to be combined with other investments to create a fully diversified portfolio.

If a sponsor chooses a TDF series as the QDIA, we encourage the sponsor to ensure that their service provider conduct thorough education and monitor the plan for individuals that are misusing the TDFs.

1.3. Fiduciary Concerns with TDFs

It appears that some sponsors are under the impression that by choosing TDFs as QDIAs they are relieved of fiduciary liability. That is not the case. Sponsors must choose the TDFs through the same fiduciary process as any other investment option. Since TDFs with the same target date can differ in several ways, fiduciaries should take care to understand the underlying investment choices made by the managers of the TDF. For example if the plan’s investment committee has created an Investment Policy Statement (IPS) that excludes certain types of investments in the fund line-up, they should ensure that the TDF doesn’t invest in those holdings. Some of the alternative investments making their way in to TDFs include: commodities, real estate, high-yield bonds, and absolute return funds – which can utilize complex strategies. TDF managers differ on whether or not these strategies are appropriate for TDFs. Charlson and Pavlenko (2011) report that the spectrum of alternative use ranges from a maximum of 20% to a minimum of 0%.

The proponents of alternatives point to their low correlation with traditional asset classes. Those critical of alternatives, point out that alternatives can add a significant amount of volatility to a portfolio.

Understanding what asset classes are in the TDFs can be difficult for plan sponsors to discern because TDFs are not required to disclose their allocations at the subasset-class level. This ambiguity makes it difficult for the plan sponsor or designated investment managers to make fully informed decisions about which TDF series to utilize, which creates uncertainty and risk for the plan sponsor.

Regardless of how a sponsor feels about the use of alternatives, they should ensure that the TDF investment choices are in line with the IPS and the investment philosophy of the investment committee and if the TDF does not fully disclose the subasset classes the decision makers may find it prudent to look for a TDF with more transparency.

1.4. Complications in Choosing a TDF

While TDFs represent a single category of mutual funds, they have a wide degree of variation. Active versus passive, glide paths, and costs are the three largest categories that lead to significant variations in risk and return profiles. TDFs will hold a significant portion of plan assets in the future and plan sponsors should pay particularly close attention to the TDF series they choose and make changes if the TDF is no longer consistent with the requirements of the plan. This can be particularly difficult for the plan sponsor because most plan providers have their own in-house TDFs and charge the plan higher costs for using a different TDF series.

Our suggestion to plan sponsors is to determine what characteristics they are looking for in a TDF and then complete a documented due diligence research process to determine which TDF series has the desired characteristics and annually monitor the TDF series to ensure it has maintained the desired characteristics. In addition, sponsors should consider choosing a record keeper that is TDF agnostic so that if the sponsor feels the need to change TDFs in the future, it won’t require the plan to move to a different record keeping platform.

Sponsors that are concerned with the potential liability of choosing the TDF for their plan should consider engaging a 338 fiduciary investment manager to chose the TDF series for them thereby relieving the plan sponsor of that liability.

References

Charlson J. & Pavlenko (2011). Target date series research paper: 2011 industry survey. Morningstar Fund Research.

Charlson, J. & Lutton, L. (2012). Target-date series research paper: 2012 industry survey. Morningstar Fund Research.

Dalbar (2013). “Quantitative analysis of investor behavior.”

Fama, E. F., & French, K. R. (2010). Luck versus Skill in the Cross‐Section of Mutual Fund Returns. The Journal of Finance, 65(5), 1915-1947.

Ghilarducci, T. (2012, July 21). Our ridiculous approach to retirement. The New York Times.

Holden, S., VanDerhei, J. Alonso, L. & Bass, S. (2012). Account balances, and loan activity in 2011. ICI Research Perspective, 18(9).

Janus white paper. (2009). “The Burden of Good Intentions: Opportunities and Challenges for Target-Date Funds.”

Investment Company Institute (2012). Average expense ratios paid by mutual fund investors continued to decline in 2012.

† Contact Author: Patrick A. Lach is an Assistant Professor of Finance at Eastern Illinois University. Address: School of Business, Eastern Illinois University, 600 Lincoln Avenue, Charleston, Illinois, 61920–3099. Office Phone: 217.581.5957. Office Fax: 217.581.6247. Electronic Mail: plach@eiu.edu.