In the last few months we’ve experienced large fluctuations in the stock market in concert with high stakes debt ceiling negotiations, financial turmoil in Europe, Libyan unrest and, oh yes, hurricanes which are expected this time of year. We are starting to get crisis fatigue. If this piece looks familiar, it’s because it is. We felt it was important enough to make it the topic of our last investment review. We felt this was an important enough message to risk repeating ourselves.

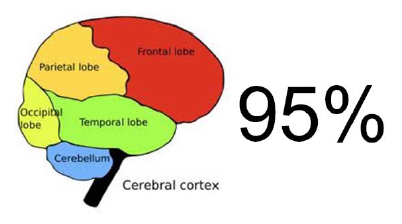

As if all the news we get isn’t enough to think about, it turns out that was just 5% of what has going on in our brains. The other 95% of our cerebral activity was subconscious, and it has been this way at least since the early hominids began to roam the plains after the last Ice Age. That’s right – 95% of our brains are Caveman brains.

As if all the news we get isn’t enough to think about, it turns out that was just 5% of what has going on in our brains. The other 95% of our cerebral activity was subconscious, and it has been this way at least since the early hominids began to roam the plains after the last Ice Age. That’s right – 95% of our brains are Caveman brains.

What we learned long ago was that when walking along, if you hear a rattle in the grass, you are better off running first and figuring out the source of the sound later. In his latest book, Our Believing Brains, researcher Michael Shermer explains how two types of errors of cognition led our brains to evolve as they did. In a Type I error (false positive), you run from the noise and it turns out only to be the wind. There isn’t a very severe consequence for this error. In a Type I error (false negative), on the other hand, you decide to sit tight and the noise turns out to the saber tooth tiger that has been stalking you. You become part of the food chain, the highest price you can pay for the error. Hence our brains have evolved to commit lots of Type I errors and to try at all costs to avoid Type II errors.

Fast forward to the 21st Century and we still have 95% caveman brains. And what does that big, subconscious brain do when faced with a threat? It wants to get out of the way. Behavioral economists have a term for this type of error we commit – Action Bias. You know the phrase, “don’t just stand there, do something!” But should we be doing something?

An example from the world of professional soccer might shed some light on this issue. Using high speed video technology, researchers* studied the results of professional goalies defending their goals against penalty kicks. A goalie has about a third of a second to get to and deflect a penalty shot fired from 40 feet away and traveling at 125 mph! 85% of penalty shots on goal result in scores. An analysis of 286 penalty kicks showed that goal keepers typically jump left or right, guessing where the ball will be kicked, but is this the right strategy?

As it turns out, the answer is no. Soccer goal keepers jump right or left 94% of the time, but the study showed that they were more successful when they stayed in the center of the net. The action bias is the reason according to the researchers. Even though the result is measurably worse, goalies get “credit for trying” as they spring dramatically right or left, even if they are wrong.

Let’s bring this back down to our level of behavioral economics and our own action bias. Research from Terrence O’Dean at UC Berkeley and others show that taking too much action in finance regularly hurts our results. For example:

The never-ending ‘crises’ highlight this even more. Despite how it might be played in the media, a 10 or 15% dip in stock market values is not the equivalent of an attack by a large carnivore. Excessive trading increases costs and taxes and, if anything, has been shown to produce worse results. That is why we advocate sticking to a great strategy and executing it well. That combination makes for one of the besstress relievers we know. Please give us a call anytime to review how we’re implementing that for you.

* Research headed by Michael Bar-Eli at the Ben-Gurion University of the Tel Aviv in Israel

**Brad Barber and Terrence O’Dean, “Boys will be Boys: Gender, overconfidence and com*** Dalbar, 2011 QAIB (Quantitative Analysis of Investor Behavior), March 2011