The quarter ending September 30th saw investment losses across a variety of asset classes, knocking recent winners off their perches and reducing one year gains down to a more modest range. The overall US Stock Market as measured by the broad Russell 3000 index managed a slim gain of 0.01% over the most recent quarter, while smaller US company stocks, international stocks and real estate investment trusts fell sharply.

In his 1949 book, the Intelligent Investor, Benjamin Graham coined the term Mr. Market, a fictional character meant to represent the emotional nature of the Stock Market. The reader is asked to imagine having a business partner named Mr. Market whose mood swings wildly between exuberant optimism and abject depression. One day he offers to pay an exorbitantly high price for your share of the business when his mood is positive and only a fraction of that price the next day when he’s depressed. Despite no significant changes day to day in a particular business, prices move up and down based on Mr. Market’s mood.

represent the emotional nature of the Stock Market. The reader is asked to imagine having a business partner named Mr. Market whose mood swings wildly between exuberant optimism and abject depression. One day he offers to pay an exorbitantly high price for your share of the business when his mood is positive and only a fraction of that price the next day when he’s depressed. Despite no significant changes day to day in a particular business, prices move up and down based on Mr. Market’s mood.

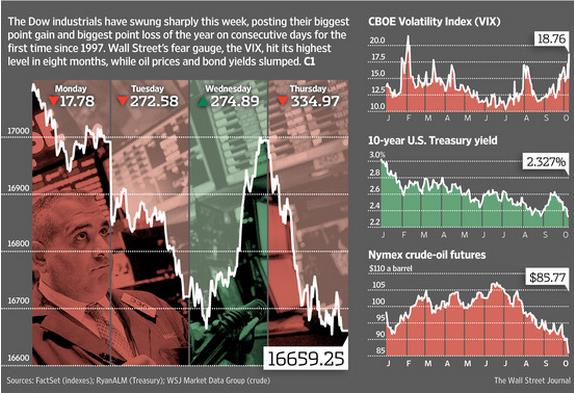

Recent daily moves, up and down, seem to be consistent with the bipolar diagnosis. Depending on one’s frame of reference (or belief system), these swings will be categorized by pundits as one of: the beginning of the end (the bearish, negative view); proof of the resiliency of the stock market that keeps bouncing back (the bullish, positive view); or something in between. We can’t know at this point which short term forecast will turn out to be more accurate, so how about an alternate theory?

Lunar eclipses are not common, yet for a second time in 2014, the moon transformed dramatically earlier this month. Late night/early morning viewers were treated to a reddish “blood moon”. We now look at this as a rare and awesome spectacle. Tourists have been known to plan vacations around the ability to observe both solar and lunar eclipses. Mark Twain’s protagonist in A Connecticut Yankee in King Arthur’s Court uses his knowledge of an historical eclipse to threaten the King, thereby cancelling his own burning at the stake and gaining enormous power and credibility for his ability to control the sun.

"Go back and tell the king that at that hour I will smother the whole world in the dead blackness of midnight; I will blot out the sun, and he shall never shine again; the fruits of the earth shall rot for lack of light and warmth, and the peoples of the earth shall famish and die, to the last man!" From A Connecticut Yankee in King Arthur’s Court, Chapter V

What does stock market volatility have to do with a lunar eclipse or a blood colored moon? “Cultures in the past often feared eclipses, thinking that something bad was happening. But now with those fears removed by scientific understanding of what’s going on, that leaves only enjoyment.”1

feared eclipses, thinking that something bad was happening. But now with those fears removed by scientific understanding of what’s going on, that leaves only enjoyment.”1

While we can’t predict stock market moves with the precision of eclipses, we do have generations of data on stock market moves. We know that volatility is a part of the process and that market progress is often irregular. We have a strategy in place we apply to benefit from volatility (we call it rebalancing). We base our actions on rational implementation, not forecasting. Those equipped to weather the volatility will continue to profit from it, even if it’s not as pretty to watch as a lunar eclipse.

Please be in touch if you’d like to review anything about the current landscape or your plan in particular.