Are Charitable Contributions Still Tax-Deductible?

The recent tax law has changed the nature of charitable giving a bit and we’re writing with a brief summary of how you can enjoy the greatest tax-deductibility of your charitable contributions.

Generally speaking, when you make a contribution to a qualified charity or non-profit, that amount is allowed to be potentially deducted on your income tax return (and thus lower your taxes). Whether you actually end up getting a deduction depends mainly on whether or not you do what is called itemizing your deductions.

For 2019, each individual is allowed to take $12,200 off of income while couples can take $24,400 off. This “Standard Deduction” is a flat deduction the IRS offers to everyone.

But, if you have actual deductible expenses which total more than that standard deduction, you can “itemize” your deductions and claim a greater reduction in income.

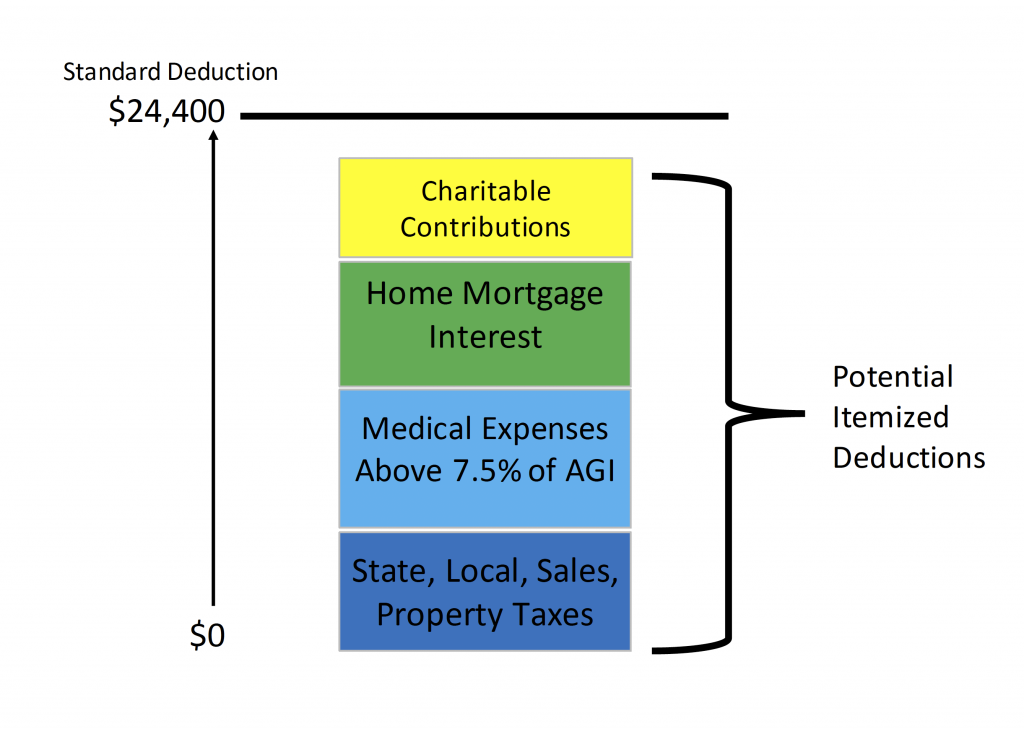

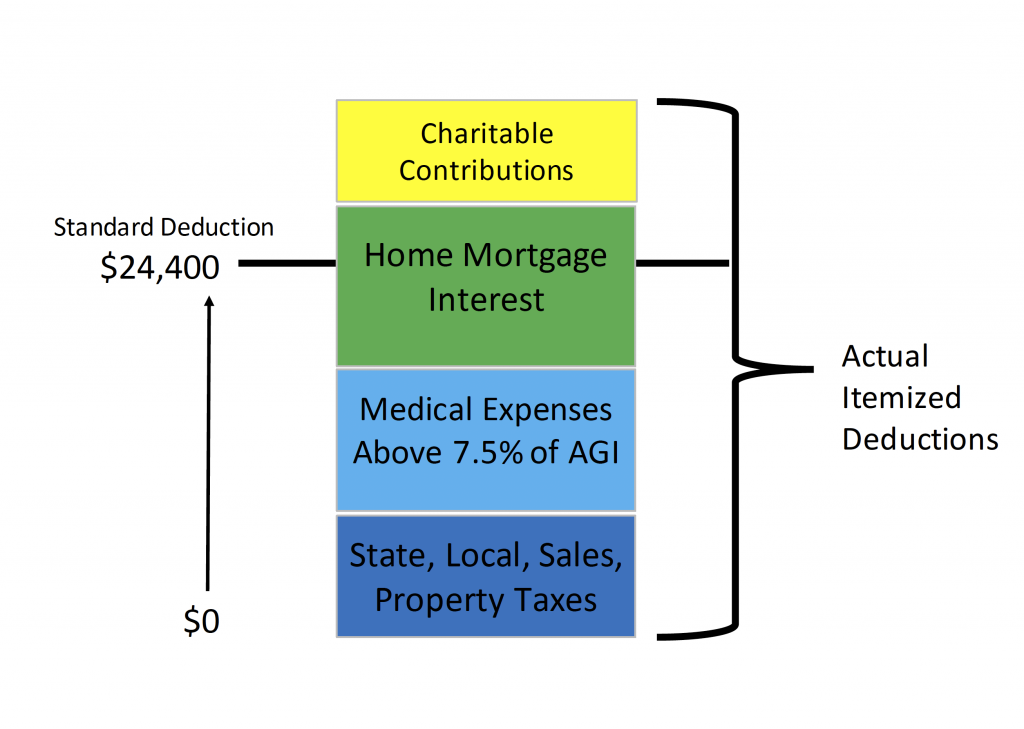

The main itemized deductions include amounts you spent on:

- Charitable contributions

- Home mortgage interest

- Medical expenses (that are over 7.5% of your adjusted gross income for 2018 and over 10% for 2019)

- State and Property taxes (but now only up to $10k per individual or couple)

If your itemized deductions total more than your standard deduction ($12,200 Individual/$24,400 Couple), you can deduct that higher itemized amount.

Thus, to actually have your charitable contribution end up reducing your taxes, you must itemize your deductions and have them total more than the standard deduction (otherwise, you’ll just choose to take the higher standard deduction.)

When your potential itemized deductions don’t exceed your Standard Deduction, Charitable Contributions don’t end up being deductible:

When your itemized deductions DO exceed your Standard Deduction, Charitable Contributions ARE deductible::

Here are two examples to illustrate:

Example 1:

James and Julie are a married couple with a home and a mortgage. Between CA state taxes, home property taxes, mortgage interest and medical expenses, they already have itemized deductions totaling $30,000. That’s above the $24,400 standard deduction available and they will thus itemize their deductions. Any amount they contribute to charity will add to their itemized deductions, be deductible, and thus lower their taxes. This is a clear case of getting to deduct charitable giving.

Example 2:

John is single and rents an apartment. His only potential itemized deduction is for California state taxes paid of $3,000. He has no other expenses he could claim as itemized deductions. Thus, at this point, he’d want to take the $12,200 standard deduction because he can’t claim itemized deductions higher than that amount.

Now, if John gives $5,000 to charity, that would bring his potential itemized deductions up to only $8,000 – still not above the $12,200 he would choose to take as the standard deduction. Thus, his $5,000 charitable contribution won’t end up being deductible and lowering his taxes.

The bottom line on whether a charitable contribution will be deductible:

- To the extent that your other itemized deductions are already above the standard deduction, then giving to charity should be deductible and lower your taxes.

- Any amount you give to charity which does not bring your itemized deductions above the standard deduction won’t lower your taxes.

The annual limit on charitable deductions:

Keep in mind that in any year, you can enjoy a charitable deduction for as much as 60% of your adjusted gross income (AGI). And if you give over that amount you can carry the unused deduction into as many as 5 future years. Thus, if your AGI was $100,000, the maximum charitable deduction you could take that year would be as much as $60,000.

How to make more of your charitable contributions deductible?

One strategy is to “clump” your charitable giving for several years into one year when that larger amount then allows you to itemize and deduct the giving. An especially useful tool in this circumstance is a Charitable Donor Advised Fund. There is a Schwab Charitable Account that allows you the full deduction in the year you make the contribution to the account while allowing you to provide ‘grants’ to charitable beneficiaries later. We’re happy to tell you more about it any time.

What about giving to charity directly from your IRA?

If you are over 70½, you can give to charity directly from your IRA account. That distribution does not get taxed to you and is thus effectively tax-deductible. It also fortunately goes towards satisfying your required minimum distribution (RMD). It takes a bit of paperwork to accomplish and is best used for more significant gifts.

What if you are subject to the Alternative Minimum Tax (AMT)?

AMT is a second way income taxes are calculated. In this method, most itemized deductions are not allowed. State, local, property and sales tax deductions are eliminated but charitable, medical and home mortgage interest expense deductions remain allowed. Because of this, it makes sense to run the numbers with your CPA to see how AMT might impact your charitable giving.

We hope this helps clarify when giving to charity helps reduce your taxes. And we are here any time to help you strategize your charitable giving.