The media continually offers up stories of investors who “beat the market” and companies that skyrocket. Sensationalism sells.

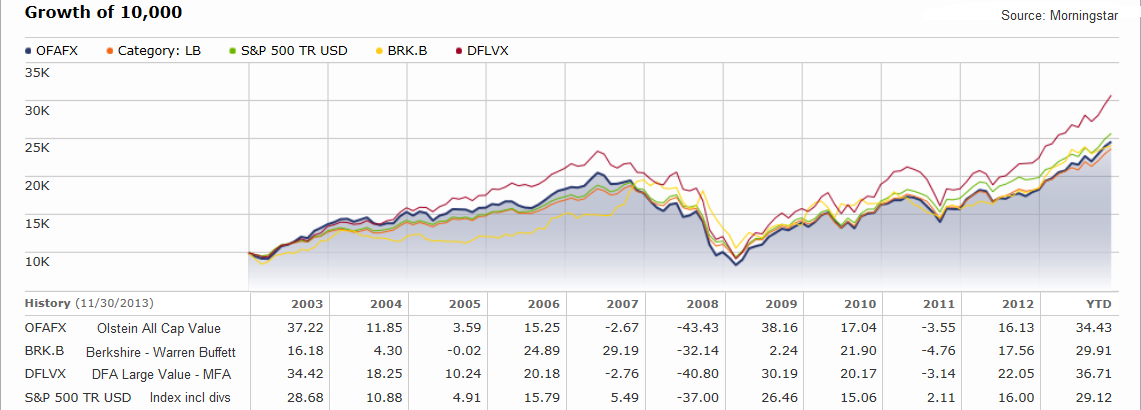

Recently the New York Times ran a story titled “Beating the Market, as a Reachable Goal”1. It profiled the Olstein All Cap Value Fund and its manager, Robert Olstein, who looks for value stocks that are unappreciated but strong by a measure known as “free cash flow yield”. According to the article since he started in September 1995 Mr. Olstein has beaten not only the market as measured by the S&P 500 but the venerable Warren Buffett via his company Berkshire Hathaway. We started using Dimensional Funds [DFA] 10 years ago and thought it would be interesting to determine how Mr. Olstein’s fund fared vs DFA’s large value fund and the S&P 500 over the last decade2. What we found is depicted in the chart below. The red line shows, a significant outperformance by the DFA fund [red line] over Olstein [blue], the S&P 500 [green] and Berkshire [yellow]. Don’t expect any puff pieces on the star manager of the DFA Large Value Fund – it is run by a committee with a disciplined process that is continually refined with the benefit of ongoing academic research. By the way, while we have a great deal of respect for the experience of Warren Buffett and Charlie Munger the managers of Berkshire Hathaway, we note that their average age is 86 leaving investors to wonder about the future management of that investment vehicle.

Bottom line: we don’t claim to place clients in investments that “beat the market” but, we do use institutional grade funds that tilt toward factors that have done so over the long term and certainly in the past 10 years.

Please give us a call if you would like to discuss any of this or have any questions.

1 New York Times December 8, 2013 by Jeff Sommer, Business page 7

2 Calendar year performance 2003-2012 and Year-To-Date as of 11/30/2013, Source: Morningstar