What is Long Term Care Insurance? Does it make sense for my situation? What are the alternatives?

Long Term Care Insurance reimburses for expenses associated with at‐home or facility treatments for patients who are impaired and can’t perform at least two of the daily activities of living; such as bathing, dressing and eating. We normally recommend that all clients consider the purchase of long‐term care insurance when they reach the age of 50. Like medical coverage, insurers can deny coverage based on pre‐existing conditions so it makes sense to consider it while one is relatively young and healthy.

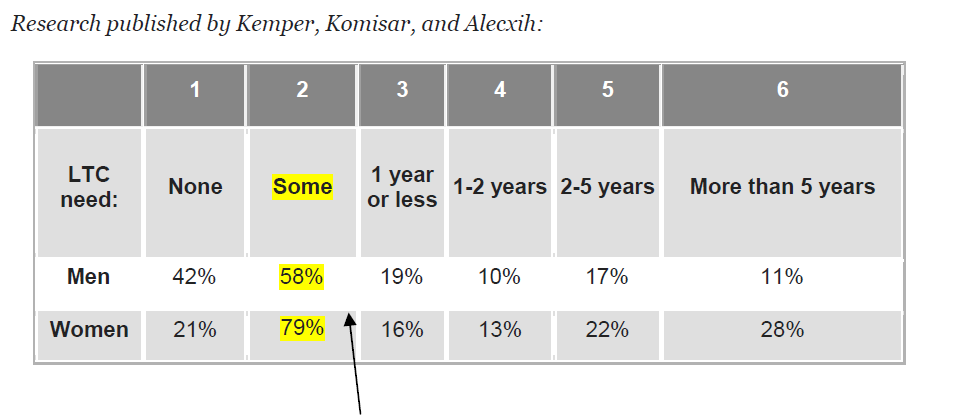

While most people might need some care during their lifetime, does it make sense to buy insurance? We encourage clients to have a conversation with us about the pros and cons as they pertain to them. This decision is informed by how much money you pay in premiums now or the higher premiums later in life, and the potential costs as well as whether family members are nearby and able to provide care.

Clients who have had occasion to collect on these policies have been very happy they purchased it. For others who have the insurance but have not collected, the peace of mind of having it in place is valuable.

The landscape in this market has been shifting. Over the last two years a number of insurers have announced their exit from the market [MetLife and Prudential most notably]. Many of these firms found that they mispriced their policies based on assumptions made years ago regarding interest rates, life expectancy and increases in medical costs. Other insurance companies have significantly increased premiums on new and existing customers to maintain viability. Genworth Financial, the insurance company with the largest market share in this sector, recently announced a premium increase estimated to be 30% for new policies issued.

We can help you find a balance between taking on some or all of the risk and insuring against catastrophic loss for a period of years.

Some alternatives to Long Term Care Insurance we explore with clients are 1) tapping home equity, 2) purchasing a unit in a building that provides long term care and 3) buying longevity insurance which pays off once you reach a certain age, such as 85. This type of insurance may be more attractive as it pays off regardless of whether there is a medical need or not and it allows us to plan for sufficient funds up to a date‐certain instead of your uncertain life expectancy.

Planning for long term care is one of those areas in our financial lives that many of us put off because it is unpleasant to contemplate. We understand that sentiment and will work with you to make it as painless as possible. We do not sell Long Term Care Insurance, but if you/we decide it makes sense for you, we can help you find an agent, review quotes, provide advice about the various levels of coverage.

If you are interested, read more on this topic.