Early January is a time when many people make resolutions for the year. Some of our clients resolve to get a better handle on spending. We have a few suggestions for you to help track income and expenses. Below is a quick summary of three options, one is an online resource and the other two are tools that we created at MFA.

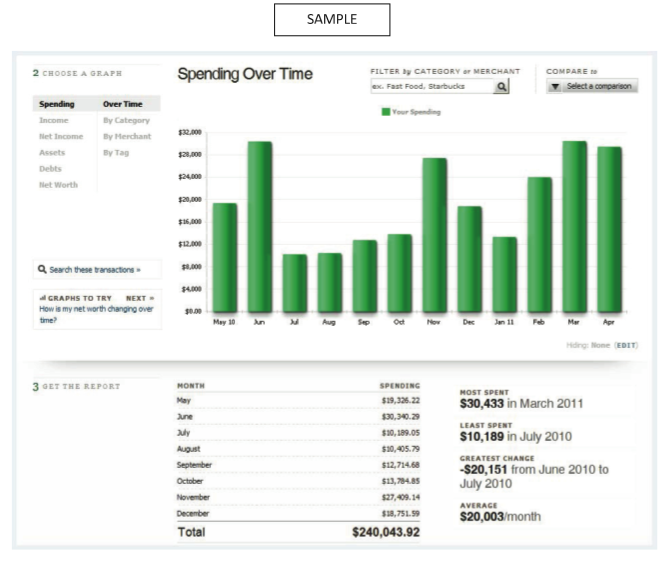

A favorite online tool is the free website called Mint.com. It will track checking account income and spending and credit card expenses. You have to be comfortable with logging into your accounts through their secure site and be willing to deal with a few suggestions by sponsors trying to sell you a financial solution. Overall, the site is very clean, the graphics are crisp, and (fortunately) the solicitations are subtle. Below is a sample of what you might expect to see at Mint.com if you spend on average $20k per month. You can also drill down into the specific categories to learn where you’re spending more or less than expected.

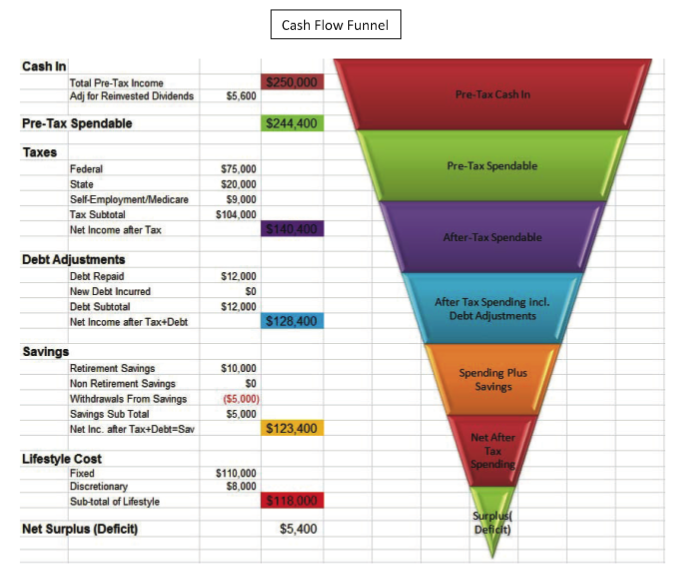

At MFA, we have developed a spreadsheet and chart that we complete with clients that helps clarify “money in and money out”. If you are like many clients, you know how much you make, have a rough idea of how much you spend but still don’t know what happens to the difference between those two figures. The chart below includes some easily forgotten items such as taxes, debt repayment and savings:

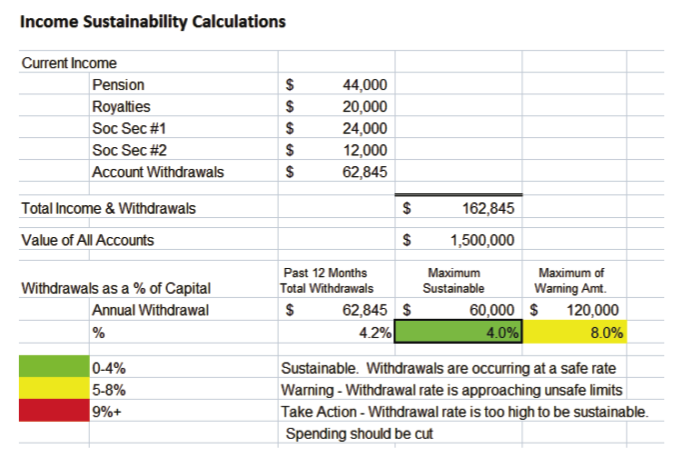

Finally, we developed a tool for clients to show if the withdrawals being made from their portfolio are sustainable over the long run. Depending on the individual situation the outcome could be green which may result in our encouragement to spend more; yellow which is cause for caution; or red in which case we will urge them to take action to reduce spending or increase income. Below is a sample output of our withdrawal monitoring tool:

We wish you a healthy and prosperous 2012! Please email or call us if you would like help with analysis of the “ins and outs” of your financial life.