There are two investment dictates you’ve certainly heard from us: Make sure that you are broadly diversified and stay fully invested.

You understand that being broadly diversified across many stocks reduces your risk of being over-concentrated in one or a few stocks that risk suffering a poor fate. You also understand that, as much as we wish we could time the market by being in while it’s rising and out when it’s not, there is no crystal ball or proven reliable method for determining this correctly and consistently. Today we want to share with you a couple of extraordinary statistics about stock markets and returns that will deepen your conviction to diversify broadly and stay fully invested.

Why we diversify

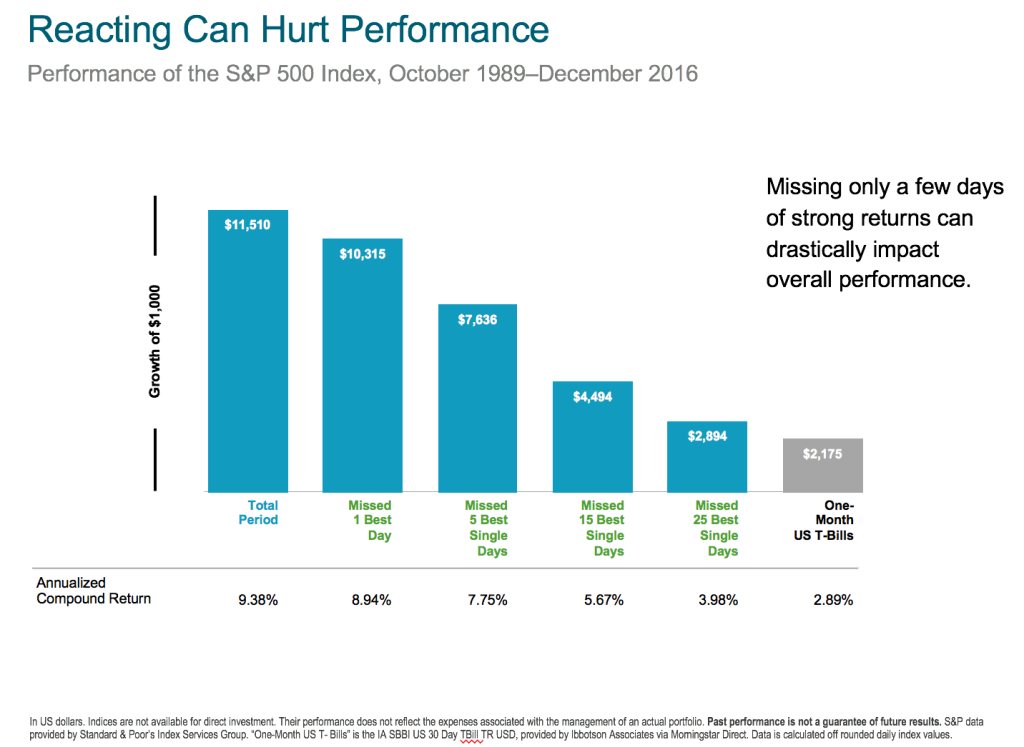

Did you know that over the last 90 years just 4% the stocks in the entire stock market have been responsible for delivering all of its wealth creation?1

Since 1926, about 26,000 stocks have been part of the US market.2 However, just 1,000 of those stocks are responsible for all the market’s wealth creation.

Further, half of the wealth creation has come from just 86 stocks! That’s less than 1/3 of 1% of all stocks.

Further, half of the wealth creation has come from just 86 stocks! That’s less than 1/3 of 1% of all stocks.

Returns from the stock market are extremely skewed to a very small percentage of stocks, and we can’t know which ones will be the winners ahead of time. It is not that only 1,000 stocks out of 26,000 made money over time. An additional 9,853 also made money, but those returns were offset by losses sustained on the remaining 14,946 stocks.

Imagine you were an apple farmer and knowing that over your lifetime although you would have 26,000 apple trees, your successful harvest would come from just 1,000 of them. And that 50% of your harvest would come from just 86 of those 1000 trees! Further, imagine not knowing which ones would be the most productive trees ahead of time.

Over their lifetimes, less than 50% of stocks have delivered positive returns and only 42% have beaten the return on 1-month Treasury Bills. Yet still, the stock market has delivered roughly 10% annualized returns over its history. That has been enough to turn $1,000 in 1928 into $3,286,459 by the beginning of this year.3

The stock market has been an extremely powerful wealth creation tool whose power has been sourced from a tiny minority of its stocks. Without any predictable and consistent method for identifying which stocks those will be ahead of time, the true risk of being an investor is of missing the opportunity to own those few stocks that deliver. Broadly diversified portfolios are poised to capture the winners, whereas concentrated portfolios with few holdings heighten the risk of missing out on returns. Yes, broad market portfolios will also include the underperformers, but have historically delivered enough return to more than make up for them. We use diversified mutual funds that cover almost the entire global stock markets. When you hold virtually all securities, you can rest assured that the winners will likely be included.

Why we remain fully invested

No doubt it is tempting to try to time into and out of the markets. We know from experience that markets have ups and downs, but is it reasonable to expect that a year’s returns will be delivered slowly, bit by bit, over the course of a year?

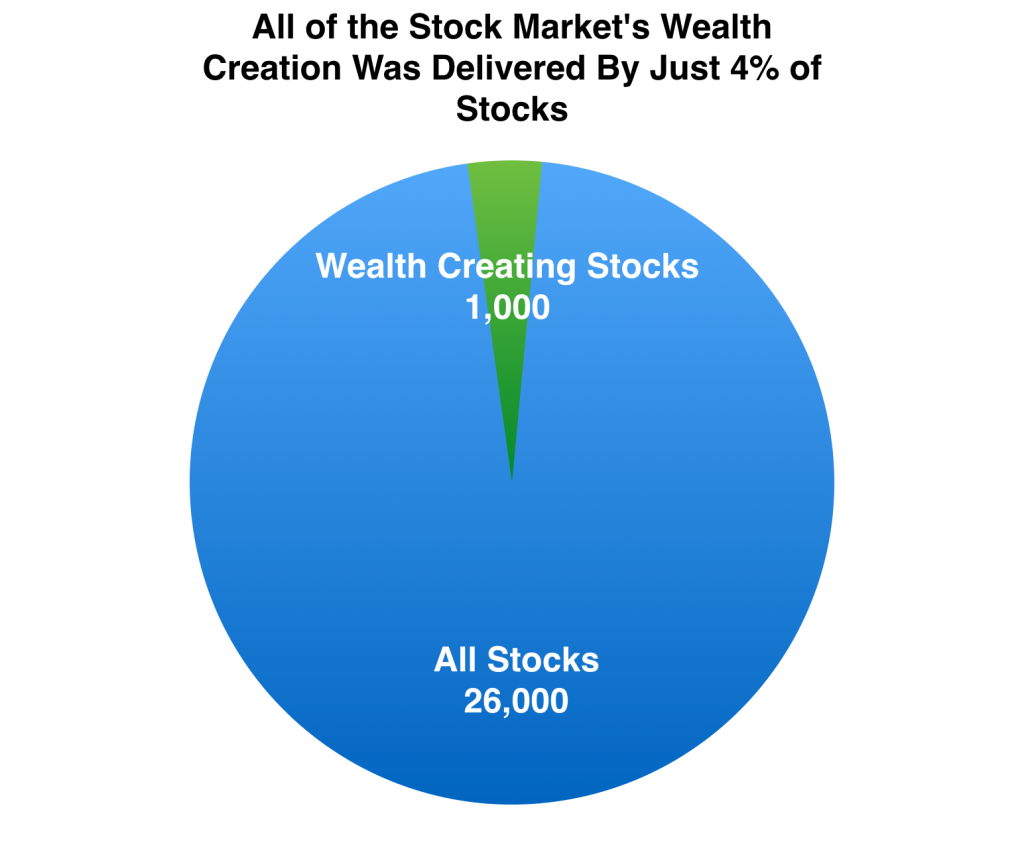

It turns out that this is not the case. Most stock market returns have been delivered in just a tiny percentage of days. One study illustrated that 95% of the market’s returns over 31 years were delivered in just 90 individual days.4 That means that 95% of the returns earned by being a stock market investor were delivered in only about 1% of trading days! That works out to almost the entire market return is earned in an average of just 3 days per year.

As shown in the chart to the right, missing only a few days of strong returns can drastically impact overall performance of a $1,000 investment over a 27-year investment horizon.

Knowing in advance which days those will be is virtually impossible. The risk of timing into and out of the markets is that you may very well be out of the markets during the few days when they deliver most of their rewards.

The bottom line is that the returns earned by being a stock market investor are earned by a surprisingly small number of stocks on a surprisingly small number of days. This shouldn’t diminish your confidence in the market’s ability to deliver growth over time but should serve as a reminder that stock market rewards are most fruitfully reaped by a broadly diversified, fully committed and patient farmer.

As always, we’re happy to speak or meet with you anytime. Just let us know.