Hint: It’s not what you think, it’s what you feel.

One of the greatest ironies of investing is that some of the simplest advice is often the most important and the most difficult to stick to. For years, decades even, we have advocated “profits through patience”, accepting the returns the global stock markets provide without the need to outguess the next short term move. Through wars, recessions, elections, natural disasters and other major news events, persistence has paid off. $1,000 invested in the US Stock Market (S&P 5001) in January of 1970 grew to just under $90,000 by the end of 2015. Yes, that’s 90-to-1 on your money, a compound rate of return of 10.27% per year.

What may seem tricky is actually quite simple. You had to practice this patience by simply staying with the program. Missing the days with the best returns along the way dramatically reduced returns over those 45 years. Below is a chart showing how much it cost to be out of the market:

| Growth of $1,000 | Whole Period | Missed 1 Best Day | Missed 5 Best Days | Missed 15 Best Days | Missed 25 Best Days | One Month T-Bills |

| Ending Value | $89,678 | $80,370 | $58,214 | $33,710 | $21,224 | $9,195 |

| Compound Annual Return | 10.27% | 10.01% | 9.24% | 7.95% | 6.87% | 4.94% |

The evidence is that there is risk to avoiding stocks, whether your perspective is that of a long term saver in her first job with 40 or more years to work and save, a retiring 60-year-old with twenty or thirty years or more to enjoy what you have accumulated, or a grandparent trying to kickstart the inheritance of future generations.

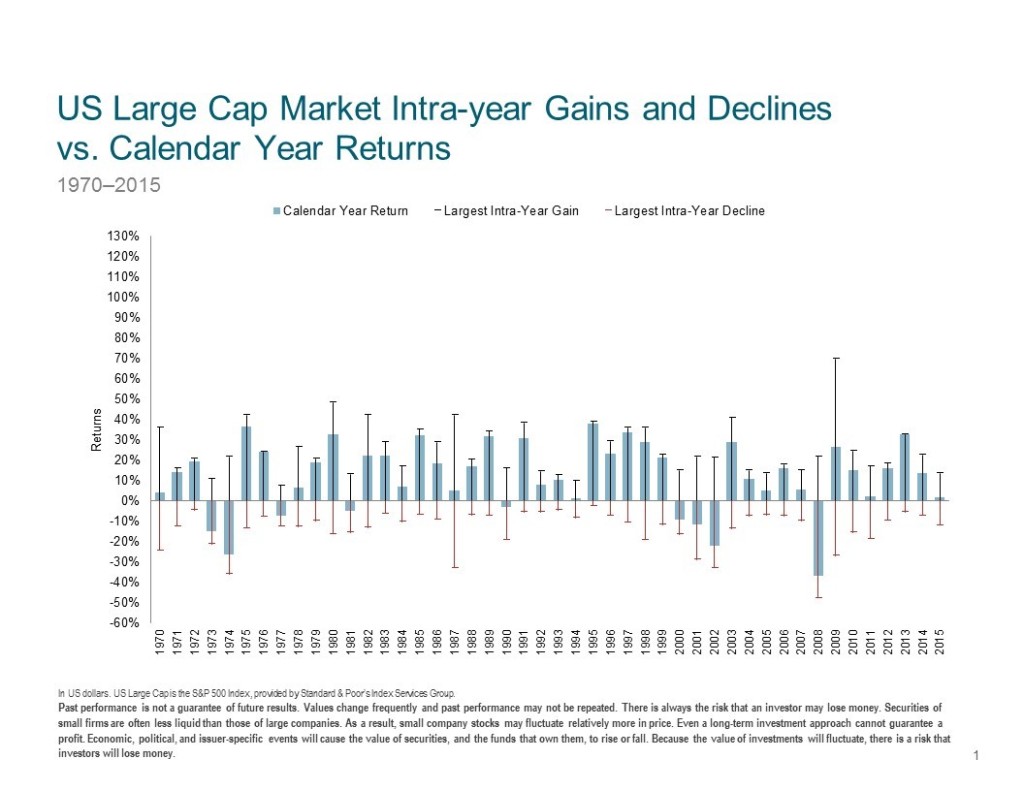

Some of the wilder rides include:

1987 – The year of the Crash of ’87 – the market ended up a modest but solid 5%, but investors had to endure a peak to trough drop of 33% (2/3rds of that coming in one day!) and a 41% gain from trough to peak.

2003 – After 3 years of devastating declines in technology stocks, the overall stock market started off ominously, down 14% in the first 9 weeks of the year, only to rally over 40% to finish the year up 29% and begin a long recovery.

2008 – The Great Financial Crisis cost the US Stock Market 37% in 2008, even though it saw an intra year rise of over 21% at one point.

2009 – There seemed to be no end in sight to the losses, at least through early March, as the market started that year losing another 27%, only to rise as much as 70% during the year to finish up 27% for the calendar year.

|

The stock market moves around a lot as it pursues a long term pattern of growth, giving investors time and time again the opportunity to practice the patience required to achieve their long term goals. Uncertainty in the market can cause an investor to become emotional, and it becomes even more important to stick to their long term investment strategy and financial plan. Unfortunately, not all investors succeed in this game of discipline. For an investor, getting wrapped up in the news and ultimately their emotions can lead to making market timing decisions that can diminish returns and only increase stress. As famous investor and author Benjamin Graham wrote in The Intelligent Investor in 1949: “The investor’s chief problem – and even his worst enemy – is likely to be himself.”

Say you read an article or watch a newscast that has you convinced that the market is about to crash and you decide to act. You sell. You are now in cash, earning close to zero. You may have made money that you will now have to pay taxes on. But the hardest thing about this scenario is that you now have to decide what to do next. Do you stay out? Do you get back in? If so, when? What if you read a different compelling point of view that convinces you that you should be invested?

Entering a cycle of trying to time the market, either in an attempt to limit loss or increase gain, puts you in a position of paying a “life tax”, a drain on your energy, that isn’t necessary. Worse, there is ample evidence that most people who try to time the market are worse off for the effort 2.

Having a dynamic rebalancing strategy in place, responding to market moves as they happen, will help to buy low and sell high a little bit along the way. Disciplined investors will be able to tune out the noise from the news and meanwhile, the returns of the markets, patiently captured, will get us where we need to go over time.