Why Do We Keep Repeating Ourselves?

Answer: because on average, a gold fish has a longer attention span.

The latest scores on American attention spans are in, and they are not encouraging. Since 2000, the average American attention span1 has fallen from 12 seconds to 8. The average score for a gold fish is 9 seconds. Most educators and psychologists agree that the ability to focus attention on a task is crucial for the achievement of one’s goals. It’s no surprise attention spans have been decreasing over the past decade with the increase in external stimulation. And it’s not just the trivial data that we skip over:

| Attention Span Statistics | Data |

| The average attention span in 2013 | 8 seconds |

| The average attention span in 2000 | 12 seconds |

| The average attention span of a gold fish | 9 seconds |

| Percent of teens who forget major details of close friends and relatives | 25 % |

| Percent of people who forget their own birthdays from time to time | 7 % |

| Average number of times per hour an office worker checks their email inbox | 30 |

| Average length watched of a single internet video | 2.7 minutes |

Our shortening attention spans are showing up in our investing behavior as well. As Nate Silver points out in his book The Signal and the Noise, people held stocks for an average of 6.3 years in the ‘50s. Hold times declined every decade until the 2000s, when they held steady at around six months on average.

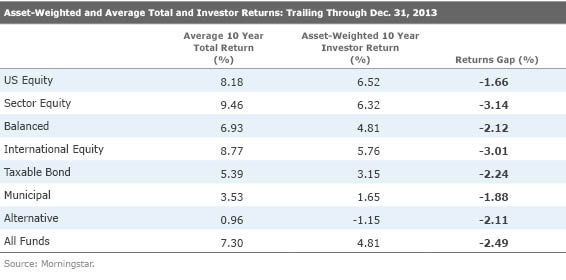

Gut decisions based on what feels right don’t appear to be helping investors’ results and may even be helping to widen what financial writer Carl Richards has coined as The Behavior Gap. He defines the behavior gap as the difference between what investments earn and what investors actually earn due to these emotionally triggered decisions.

We just received another set of data that confirms that the pattern is still firmly in place. Morningstar reports in their annual Investor Study that the tendency to underperform is getting worse. According to their article,

“The 10-year gap between the average investor and the average fund ballooned to 2.49% by the end of 2013 from 0.95% at the end of 2012. In sum, the typical investor gained 4.8% annualized over the 10 years ended December 2013 versus 7.3% for the typical fund. The biggest gaps were in sector funds and international equity. That’s not surprising, as more-volatile funds tend to lead to bigger gaps.” 2

As fiduciaries and friends, we consider ourselves to be co-stewards in helping our clients to build and preserve wealth. Real money is squandered to rapid trading and emotionally driven buy and sell decisions. We enjoy helping clients avoid behavioral gaps.

Our investing decisions are driven by data, not drama, and implemented with discipline, not guesswork. We’re sorry if we repeat ourselves.

1 According to the National Center for Biotechnology Information (U.S. National Library of Medicine), research date 01/01/2014. Attention span is the amount of concentrated time on a task without becoming distracted.

2 Russel Kinnel; 02/27/2014 Morningstar.com