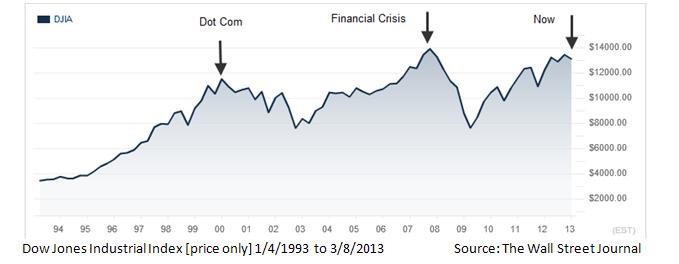

Recently US stock market indices have reached record highs. The last two times a record was set was in October 2007 and March 2000 and significant downturns followed the “financial crisis” and the “dot com bubble”.

We have heard from a handful of clients who are concerned about investing during/at the market “top”. The question is usually along the lines: “Should we really be investing in stocks now that we’re at a record high”? In cases where we are putting new money to work the concern is: “Aren’t we buying high”?

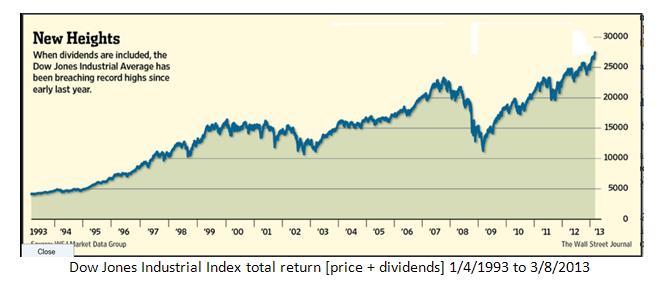

The chart below is also the Dow for the same period of time but it includes dividends. Notice the smoothing out of the results and the scale at the right. This chart is a more accurate depiction of a disciplined investor’s actual experience as they earn dividends on top of price appreciation.

Context is Everything.

What does Taken out of context mean? A Wikipedia search yields a statement we can agree with:

To take something out of context is to ignore the overall meaning of an utterance in order to assign undue importance or meaning to a part of it

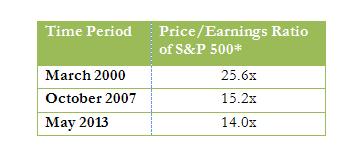

A more relevant way to ask the question, “is the stock market too high” is to add, “compared to what?” Below we have created a chart showing the price-to-earnings valuation at the three “peak” periods.

Without making a prediction, we are trying to put current information in context. Research by the Vanguard Group and others has demonstrated company earnings have the strongest relationship to future stock market returns. Lower price-to-earnings ratios signify cheaper values. The current P/E ratio of 14x is not at the bargain basement level but virtually equal to its 10-year average of 14.1x so we would argue not “overvalued.”

In addition, part of the context is related to what our other investment alternatives might be. The current 2% dividend yield from holding the S&P is more than competitive with the 10 year Treasury yield of 1.8%.

|

|

||||||||||||||

Few of our clients are invested in all stocks and none in just the Dow or S&P 500. However, this analysis confirms to us that our long-term and disciplined approach to investing is still a prudent way forward.

*Source – FactSet – price of the S&P 500 divided by projected earnings over the next 12 months

** Source www.treasury.gov US Dept of Treasury [3/16/00, 10/31/07 & 5/06/13]