This will certainly be a quarter to remember.

With the global spread of Covid-19, we witnessed the fastest onset of a bear market ever. Performance figures for this quarter reflect that. We are not making too much of them and encourage you not to either.

Fortunately, we’ve also experienced a fast and large rebound since the end of the quarter and your

current numbers (which you can find on your private client portal) look better than those in your

quarterly report.

While the word “Zoom” is now ubiquitous thanks to the rise of that now-popular videoconferencing service, we are writing about a different zoom today – the zooming out of our perspective.

4 pictures can help explain why that makes sense:

- We are in control of how we choose to place our focus – on days or on decades.

The narrower our focus, the more volatile our experience. Daily market movements have little meaning but much drama. Multi-year periods offer more predictable and reliable experiences (as seen in point 3 below). You are in control of how the investing experience feels. It can really help to “zoom out” to the bigger picture.

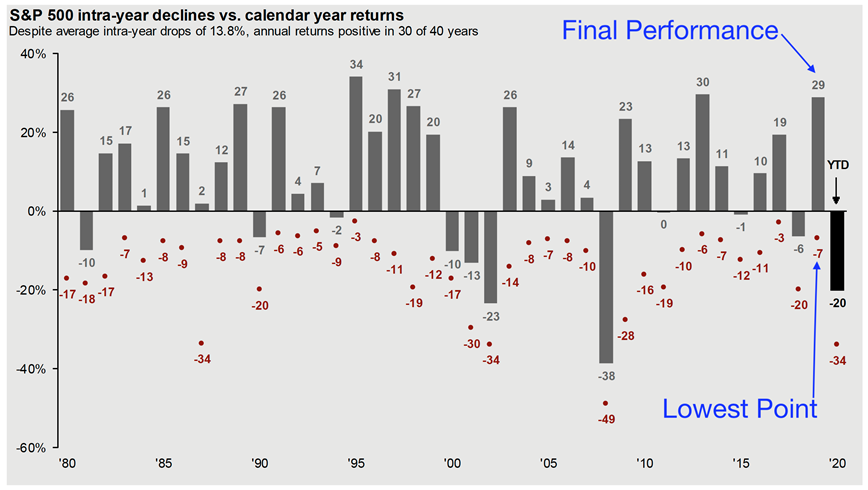

2. It’s usually not as bad as the worst day would have you think.

The table below shows the annual return of the S&P 500 index (the grey bars) since 1980. It also shows the lowest point to which the index had dropped during the course of the year (the red dots) before ending the year at the grey bar.

For example, look at last year (the second-to-last grey bar on the right). The S&P 500 returned 29% for the year. But there was a point last year when the index was down -7%. If you look at this year (the black bar on the far right), the index has been down as far as -34%. At the end of the quarter, it was down -20%. (As of 4/14/20, it’s down just around -11%.)

The market is down at some point every year – by 13.8% on average. And it has gone on to have positive returns in 30 of the 40 years illustrated. In every case, the worst day was just an unpleasant touchpoint on the way to better performance than that day.

While we could certainly see further declines this year, it’s helpful to remember that virtually every year ends up better than its worst day. Thus, don’t make too much of the darkest seeming days.1

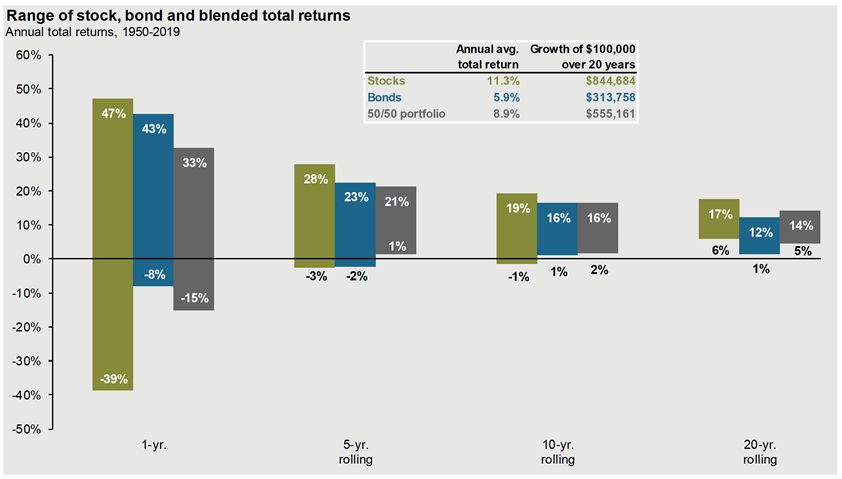

3. Time delivers more predictable outcomes.

The range of outcomes investments deliver in one year can be very wide. For example, in any one year, the S&P 500 has delivered a return as high as 47% and as low as -39% (shown by the far left green bars below). It can be unsettling to have such a wide range of possible outcomes.

If you look at any 20-year period (the green bar at the far right), the highest average annual return has been 17% per year and the lowest has been 6% per year. That’s a more comforting and positive range of possible outcomes.

Two things happen as you zoom out to look at longer returns. (1) The range of possible outcomes narrows, and (2) The averages eventually all fall in positive, quite acceptable, territory.

And you’ll note that when you combine stocks and bonds, you narrow the possible range of outcomes as well. That’s the main reason we hold bonds – to dampen the downside and more quickly get to positive average returns. 2

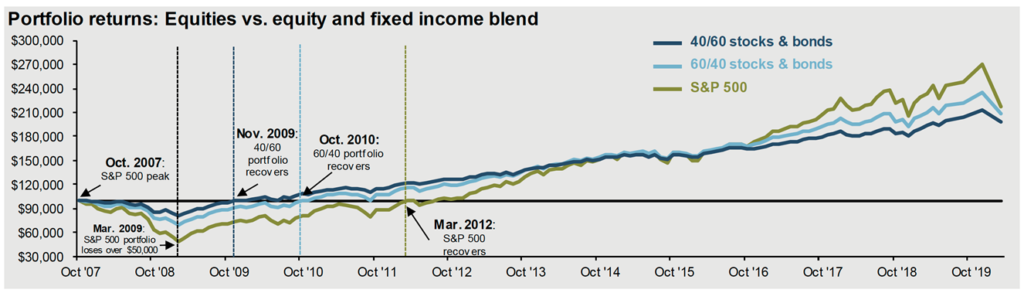

4. Bonds help portfolios recover more quickly.

As noted above, we hold bonds to dampen volatility and get back to positive returns more quickly after downturns.

The graph below illustrates the fall and recovery from the financial crisis of 2007.

• The green line represents the performance of the S&P 500.

• The light blue line represents a portfolio with 60% bonds and 40% stocks.

• The dark blue line represents a portfolio with 40% bonds and 60% stocks.

The main thing to note is that bonds (1) dampened the fall and (2) shortened the amount of time until recovery.

• Stocks took about 4.5 years to recover to their previous peak.

• A portfolio with 40% bonds took 3 years to recover.

• A portfolio with 60% bonds took just 2 years to recover.

Remember – you are not “the stock market” – you are a diversified portfolio. 3

We expect that this could continue to be a challenging year for us as investors. We are frequently being tested. But, we keep zooming out to a broader view and it helps us keep perspective.

We are here to help you maintain a helpful perspective when things get challenging – please always feel free to call so we can talk it over.