We live in a world where we often have a skewed perspective about risk and don’t realize it. For example, do you know people who wouldn’t swim in the ocean after seeing the movie Jaws? You might even know people who wouldn’t evenswim in a lake. That’s because somehow that dramatic (and terrifying) movie raised the perceived risk of sharks to totally disproportionate levels. (In case you are wondering, the odds of a shark getting you are 1 in 3.7 million.)

It’s very easy to have dramatic events take on a heightened sense of riskiness or likelihood. For example, in our times, there exist significant fears about homicide and terrorism. Acts of terrorism lead to less than 0.01% of US deaths while getting over 35% of death-related media coverage attention. Homicides lead to less than 1% of deaths while getting almost 23% of that media coverage attention. That means that over 50% of the media coverage relates to the causes of only about 1% of deaths. (Meanwhile, heart disease, the leading cause of death at 30%, gets only 2.5% of coverage) ¹

It’s easy enough to understand why – plaque buildup in the arteries doesn’t make for a particularly visible or dramatic villain the way a terrorist, murderer or shark does. Nightly news reporting that the greatest risk to your life is clogged arteries does not make for engaging viewing.

This disconnect between what really matters and what the media leads us to believe really matters leads to just as much distortion when it comes to investing.

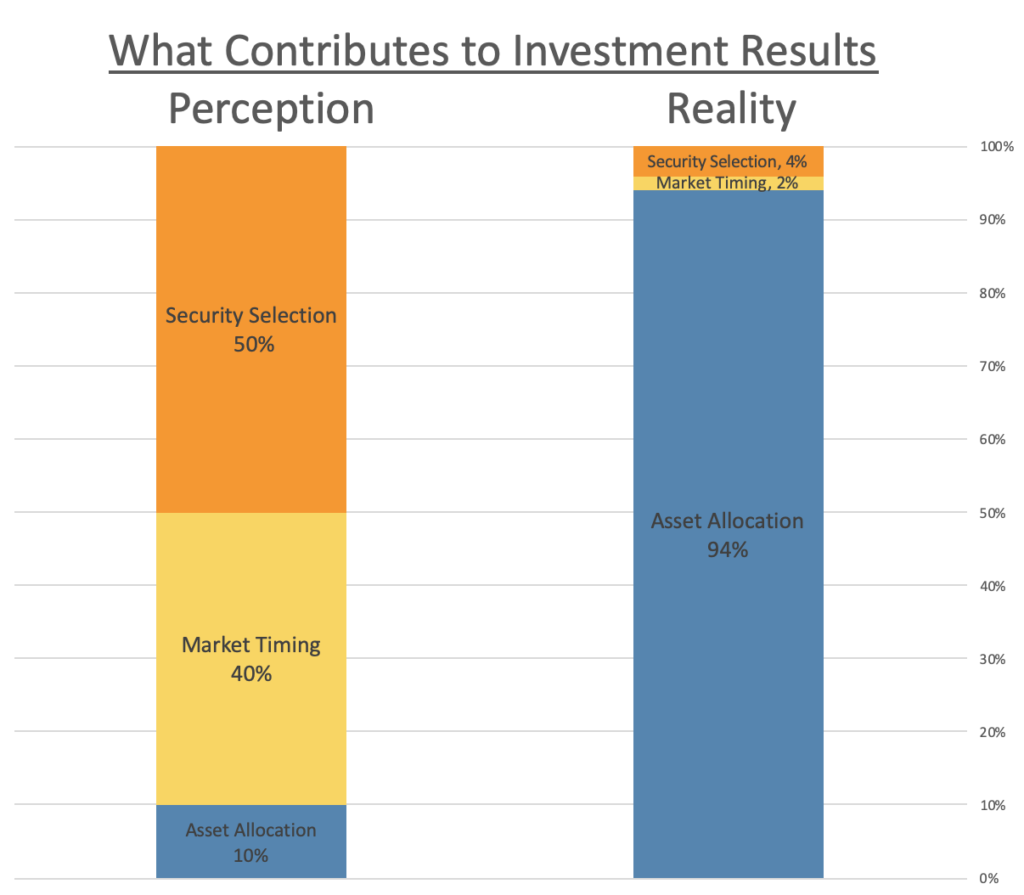

Let’s look at the chart below for how this translates.

The left column is a rough estimate of what the media would have you believe leads to your overall investing success:

Security Selection is about picking the right investments, Market Timing is about holding them at the right times, and

Asset Allocation is about having your money spread between different types of investments (stock, bonds, real estate, etc.)

The reality (as confirmed in various studies2) is that it’s actually asset allocation that explains most of the difference in various portfolios’ performance. While the media hammers us with stories about the economy, the stock market, the latest hot stock tip, and questions about whether it may be time to get in or out of the markets, the steady reality is that a broadly diversified portfolio and the discipline to stick with it are the two key determinants in long-term success.

For a long healthy life, we focus on balanced eating and exercise to reduce the risk of heart disease and cancer. For a long-lived healthy portfolio, we focus on stripping out the stock picking and market timing, focusing on a balanced and diversified mix of investments.

Let’s keep our focus in the right place.