Are we in a U.S. recession? Are we in a bear market? Probably neither.

There was no place to hide in 2018. Virtually every asset class around the globe had negative returns. In 2018, the U.S. total stock market was down -5.24% while both developed and emerging international markets were down a bit over -14%. Global real estate was down and -5.9% for the year. 1

Most of the pullback came during the last quarter of the year. From their 2018 peaks, and with much media fanfare, global markets approached or entered “bear market territory” (losses of 20% or more) during the worst December since the Great Depression.

Meanwhile, US bonds were flat or slightly down while global bonds were up modestly. They did their job of preserving capital but contributed little to returns. This all combined to deliver negative portfolio returns for the year.

Fortunately, portfolios have had a nice recovery since year-end.

What are we to make of all this? Here are some key lessons and reminders.

Negative returns are normal. The US stock market (S&P 500 Index) is up in about 2/3 of calendar years and down in 1/3 of them. We happen to be coming off of 9 consecutive years of positive returns for the S&P 500 – and 13.1% annualized returns for the 10 years through and including 2018. It’s normal and acceptable that we should have a negative year.

Not only are negative returns expected, they are the very thing we make ourselves willing to accept in exchange for seeking healthy longer-term annual returns. It’s also natural to dislike the experience of loss. It’s important to remember that the experience of being an equity investor is generally one of seeing your portfolio grow, then pull back, and then a subsequently grow again and exceed your previous high value. That pullback is expected and acceptable.

The stock markets and the economy are not the same thing. 2018 was a year full of good economic fundamentals – record low unemployment, healthy GDP growth, solid corporate profit growth, and low inflation. It was in the midst of this positivity that markets dropped. The fall was attributed to a number of uncertainties, because “the market dislikes uncertainty”. With the Fed continuing to raise interest rates, trade tensions with China, the government shutdown and border wall impasse, Brexit uncertainty and Chinese and European economic slowdown, investors got worried and then spooked, leading to a fast and severe selloff.

Markets look ahead and try to price themselves for the future profitability of corporations. Given the absence of crystal balls, that process can be chaotic. Market pullbacks tend to precede economic recessions but are not the same thing.

Markets rebound – Stay invested. Dave likes to call the December pullback the “Bear Market*” – the asterisk signifying that it was just shy of actually crossing the 20% loss mark and then quickly bounced back. Since its December 24th low, the U.S. market (Wilshire 5000 index) has rebounded about 11%. This is another great illustration of why we don’t recommend selling out of stocks during volatile times – it’s too easy to miss the much-needed rebound in prices, and that rebound is very probable and usually generous. After declines of more than 10%, equity returns in the following 12 month period have been positive over 70% of the time, both domestically and in developed international markets.2

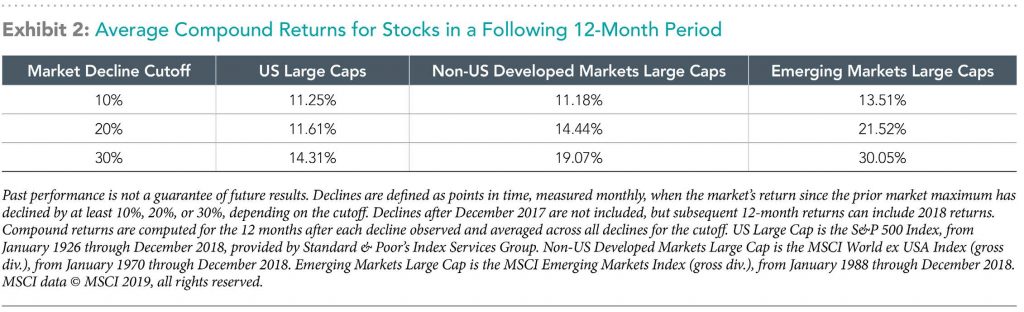

The table below shows the performance of U.S., international and emerging market stocks in the 12 months after declines of 10%, 20% and 30%. For example, U.S large company stocks have averaged 12-month returns of 11.25% after a drop of 10%. The moral: When you have already “paid the price” of being an equity investor (suffered a loss), make sure you stick around for the rewards.

Forecasts are not very useful or accurate. We didn’t see this December market downturn coming, nor do we know anyone who did. We also do not know a single individual who has created his or her wealth from consistently correctly timing the markets. It’s not your job as an investor to circumnavigate these storms. Rather, your mission is to have a ship sturdy enough to weather them and the discipline to push on through.

Focusing on you:

There’s a lot of handwringing going on about the global equity markets and the world economy. We don’t have any control over those and don’t need to in order for you to be successful. Rather than focusing on the global economy, we keep our efforts directed at your personal economy. We focus on what’s going on in your personal financial life and helping keep you safe and on track.

We know that economic recessions and market corrections come and then pass. To help you through those times, we keep an appropriate allocation to bonds and cash which hold up just fine during stock pullbacks. That gives us “dry powder” to rebalance back into stocks at better prices. If you need income from the portfolio, we prepare with a sufficient reserve of cash to draw upon while riding out the correction. This strategy is effective at getting you the time needed to patiently await the inevitable stock market recovery.

As always, we’re here for you and happy to review things any time.