In response to one of the questions raised in our recent client survey, we will address how our investment approach differs from buying simple index funds and what are the results.

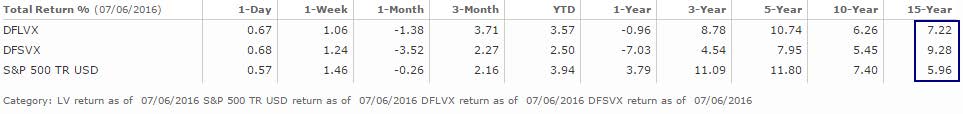

We invest your money in a globally diversified investment portfolio. Our philosophy is to avoid slavishly adhering to the major stock indexes such as the Dow Jones Industrial 30 or the S&P 500 but rather tilt the stock portion of our portfolios toward characteristics that demonstrate better results over the long run. The reason for this is not to be different but rather because a vast body of academic research indicates that cheaper stocks “value” and smaller stocks “small” perform better than larger growth stocks over time. Inconveniently, the last ten year period has not demonstrated this expected outperformance. However, the last 15 year period shows significant gains from patiently tilting toward value (DFLVX up 7.22% annualized) and small value stocks (DFSVX up 9.28% annualized) in chart below.

DFLVX is the DFA US Cap Large Value fund and DFSVX represents DFA US Small Cap Value Fund. The core US and International funds we use do not as of yet have 15-year track records. The figures above are annualized percentage returns.

As a matter of fact, the longest time period for which we have good data, the 87 calendar years from 1928 to 2015 shows that small stocks beat large stocks by more than 2% per year and value stocks outpace growth stocks by over 3% per year.

On the bond side the most widely used index is the Barclays Aggregate Index an index of US bonds. You may have noticed we don’t invest in funds that track that index either. Instead we invest in funds that provide access to global high quality corporate and government debt issuers, inflation protected bonds and municipal bonds where they make sense. We believe this mix provides us with a more diverse pool of bonds, a partial hedge against future inflation and some relief from taxation.

Finally, we are pleased that global markets have largely recovered following the shock following the decision by a UK referendum to exit the European Union “Brexit”. We emailed a note to all clients and posted to our website on June 24, 2016 sharing our thoughts on Brexit the day the vote results were announced.